Get Forex Market Insights

The FGC Currency Reports delivered to your inbox daily for only $26/month.

Forex Market Foresight

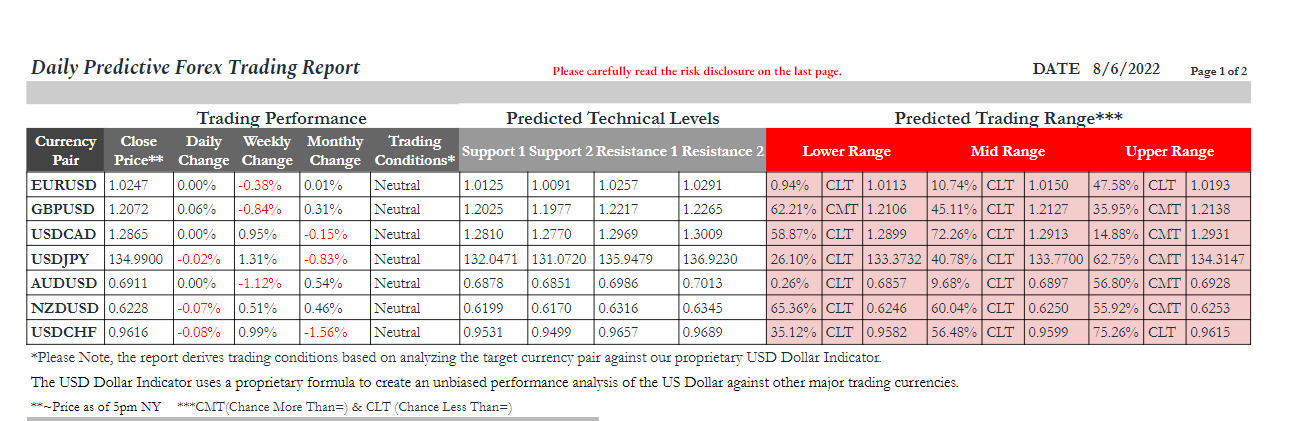

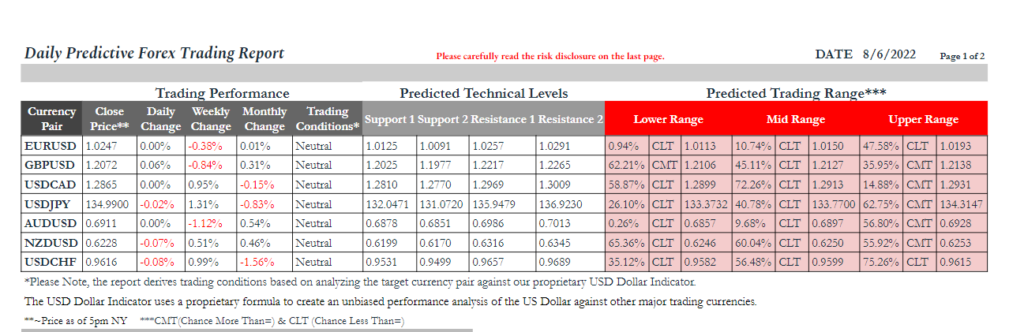

The FGC Forex Trading Report supplies Actionable Algorithmic-Driven Forex Forecasts, Predictive Trading Ranges, Predictive Trading Levels, and our proprietary US Dollar Oscillator designed to try and help Currency Traders analyze price action in the Foreign Exchange Market.

Forex & Cryptocurrency Trading

That Is Truly Ahead of The Curve

Question: With so many forex trading options available, how can the forex forecasting report developed by FGC Traders (FGC) position itself as truly ahead of the curve and impact your approach to trading?

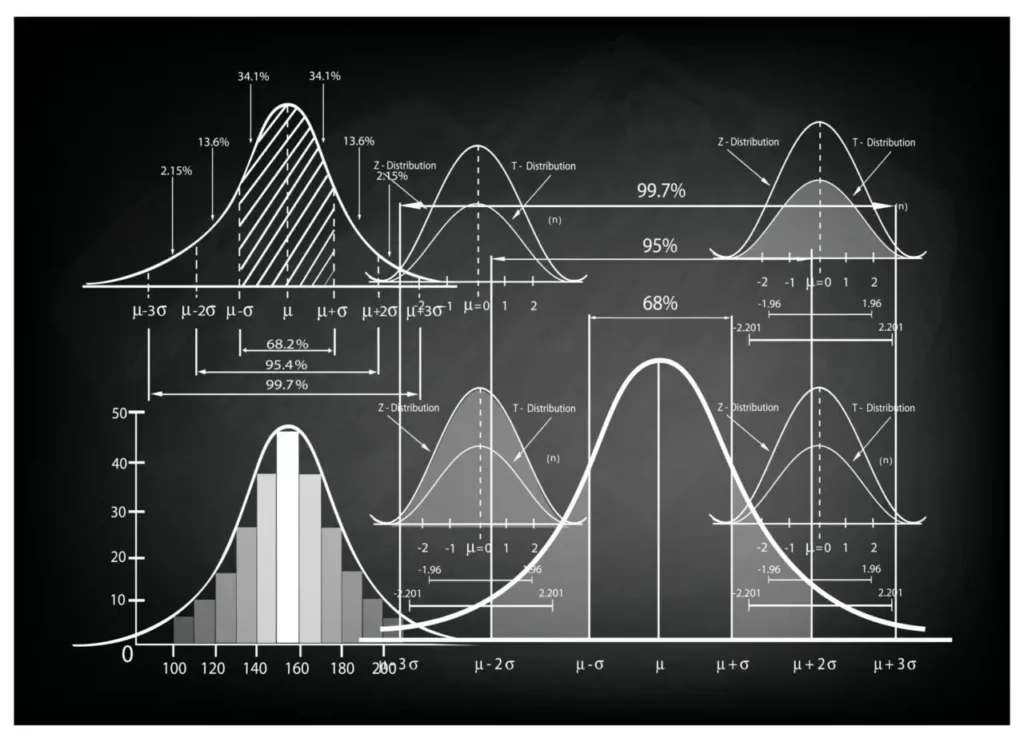

Answer: A different approach to trading in the forex market. Unbiased forex market insight, supplying a perceived directional bias based on historical factors and changing market conditions. This predictive analytical trading report tries to deliver traders with daily actionable directional forecasts and predictive trading ranges in an easily interpreted way, using algorithmic models that measure historical price action in currencies.

The Result: Model-driven currency forecasts and analysis using a tier-blend approach to centralize the most likely extreme high and low trading points for the most liquid & actively traded major currency.

A Daily Email

The FGC Forex Trading Report gets delivered to your inbox shortly after the US Market Closes. The Report includes the following for the major currency pairs: Daily Trading Performance, Daily Trading Trading Conditions (Statistically Overbought/Oversold/Neutral Zones), Predicted Technical Trading Levels (Statistical Resistance/Support Areas), Predicted Trading Range, and our proprietary US Dollar oscillator.

FGC Forex Trading Report

Subscribe to our Trading Report at $26/month

U.S. Government Required Disclaimer – Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you cannot afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFFC Rule § 4.41 Regarding Hypothetical Performance – These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

Risk Disclosure – Futures and Forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure – Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

For Full Disclosure & Terms/Conditions: https://www.franklinglobalcapital.com/disclosure & https://www.franklinglobalcapital.com/terms-conditions

For Privacy Policy: https://www.franklinglobalcapital.com/privacy-policy